S&p 500 10 Year Chart

S&P 500 10 Year Return historical data, charts, stats and more. S&P 500 10 Year Return is at 177.5%, compared to 208.0% last month and 82.08% last year. This is higher than the long term average of 138.8%.

And the tip-off is from something going on in the bond market

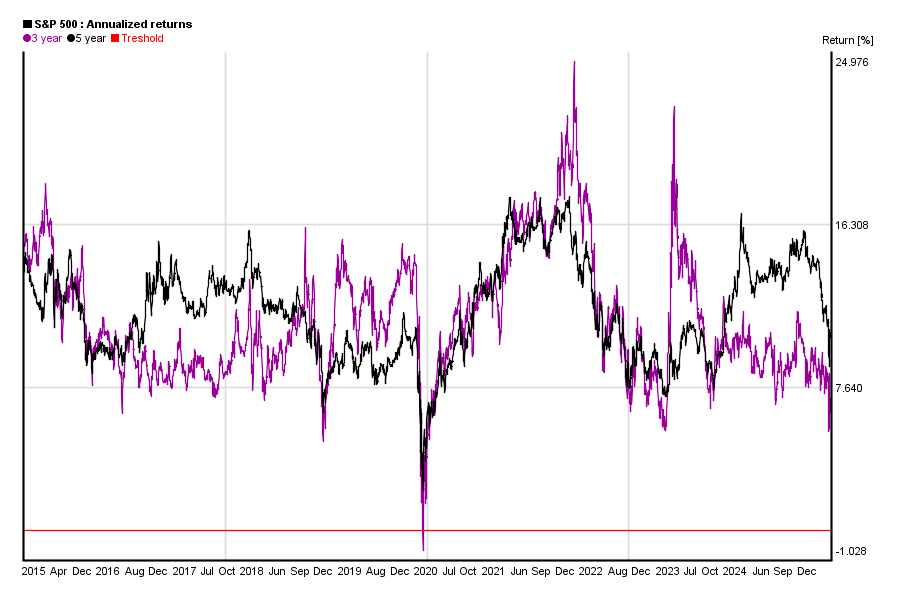

If you are an S&P Index fund investor (and so many investors are), congratulations on a stellar 5-year run. Based on recent market history, you will want to strongly consider whether the next 5 years’ return will be anywhere in the ballpark, or even on the right side of 0%.

Here’s why. In the chart above you see what I would call “modern market history” which began in the mid-1990s, or around the time CNBC came on the air. That’s when investing really started to go mainstream. Pictured are 3 items. The spread between the yield of 10-year and 2-year government bonds, which has been declining steadily in recent years. Next is the S&P 500 Index, replete with its 9 year, nearly uninterrupted bull market. And lastly, we have the annualized 5-year return of that same S&P 500. That is, at any point on the chart you can see the average annual compounded rate of return for the S&P over the last 5 years. The current reading is 11.33%, so like I said, congratulations if you are an S&P Index fund investor.

But a closer look at the charts brings an ominous conclusion for those same S&P 500 investors, and it is due to that top part of the chart, in which the 10-year bond rate is getting dangerously close to dipping below the 2-year bond rate. Any concerns about the stock market turning down, due to trade war fears, economic excess or something not yet on the radar could cause money to flood into long-term Treasury Bonds as a temporary “safe haven.”

S&p 500 5 Year Chart

And, with the Fed seemingly determined to continue raising shorter-term interest rates to fight the threat of inflation and correct the excess monetary policy of the past decade, it is easy to see how the 10-2 Yield Spread could go negative. That typically means a recession is on the way. And while that recession may not be right around the corner, the market has a habit of worrying about what may happen in the months to couple of years ahead. I suspect that process has started.

As for the S&P 500, look at what happens starting about 6-12 months before a recession occurs. You can see this as I have shaded in the last two U.S. recessions in grey for you. The 5-year return of the S&P 500 has peaked shortly before the recession started. And once that pendulum swings downward as it did in 2000 and 2007, it is probably destined to continue that way for a while. In fact, in the last 2 stock market cycles you see there, the 5-year return of the S&P 500 went negative. That’s not one year of negative; it is an annualized return over 5 years of negative!

Imagine the reaction of today’s investor when they look at their portfolio and see that for 5 years they have lost money. The first question they are likely to ask is “but wasn’t I doing so well?” And they probably were, but bear markets tend to wipe out the tail end of bull markets quickly. That leaves the unsuspecting “long-term investor” in the stock index both shocked and disappointed. As I have explained in this space constantly for the past year or so, while no one can predict the future, we can save ourselves a lot of stress by recognizing when the major trend is shifting. The picture above shows that this process is in motion. That means that investors must look at their approach very differently. This is no time for hubris.

For more insight, click HERE.

'>And the tip-off is from something going on in the bond market

S Amp P 500 10 Years Chart Over

If you are an S&P Index fund investor (and so many investors are), congratulations on a stellar 5-year run. Based on recent market history, you will want to strongly consider whether the next 5 years’ return will be anywhere in the ballpark, or even on the right side of 0%.

Here’s why. In the chart above you see what I would call “modern market history” which began in the mid-1990s, or around the time CNBC came on the air. That’s when investing really started to go mainstream. Pictured are 3 items. The spread between the yield of 10-year and 2-year government bonds, which has been declining steadily in recent years. Next is the S&P 500 Index, replete with its 9 year, nearly uninterrupted bull market. And lastly, we have the annualized 5-year return of that same S&P 500. That is, at any point on the chart you can see the average annual compounded rate of return for the S&P over the last 5 years. The current reading is 11.33%, so like I said, congratulations if you are an S&P Index fund investor.

But a closer look at the charts brings an ominous conclusion for those same S&P 500 investors, and it is due to that top part of the chart, in which the 10-year bond rate is getting dangerously close to dipping below the 2-year bond rate. Any concerns about the stock market turning down, due to trade war fears, economic excess or something not yet on the radar could cause money to flood into long-term Treasury Bonds as a temporary “safe haven.”

And, with the Fed seemingly determined to continue raising shorter-term interest rates to fight the threat of inflation and correct the excess monetary policy of the past decade, it is easy to see how the 10-2 Yield Spread could go negative. That typically means a recession is on the way. And while that recession may not be right around the corner, the market has a habit of worrying about what may happen in the months to couple of years ahead. I suspect that process has started.

As for the S&P 500, look at what happens starting about 6-12 months before a recession occurs. You can see this as I have shaded in the last two U.S. recessions in grey for you. The 5-year return of the S&P 500 has peaked shortly before the recession started. And once that pendulum swings downward as it did in 2000 and 2007, it is probably destined to continue that way for a while. In fact, in the last 2 stock market cycles you see there, the 5-year return of the S&P 500 went negative. That’s not one year of negative; it is an annualized return over 5 years of negative!

Imagine the reaction of today’s investor when they look at their portfolio and see that for 5 years they have lost money. The first question they are likely to ask is “but wasn’t I doing so well?” And they probably were, but bear markets tend to wipe out the tail end of bull markets quickly. That leaves the unsuspecting “long-term investor” in the stock index both shocked and disappointed. As I have explained in this space constantly for the past year or so, while no one can predict the future, we can save ourselves a lot of stress by recognizing when the major trend is shifting. The picture above shows that this process is in motion. That means that investors must look at their approach very differently. This is no time for hubris.

For more insight, click HERE.